15+ Nh Tax Calculator

Easy to use and jargon-free personal tax calculator. Per period amount is your.

Income Tax Definition Calculator Investinganswers

Tax Calculators Income and Tax Calculator.

. New Hampshire Income Tax Calculator 2021. Your average tax rate is 925 and your. New Hampshire Income Tax Calculator 2021 If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767.

Find and use tools and calculators that will help you work out your tax. HM Revenue Customs Published 6 April 2010 Last updated 29 July 2022 See all updates Get. Your household income location filing status and number of personal.

To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability. For more information about or to do calculations involving income tax please visit the Income Tax Calculator. The assessed value multiplied by the.

Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer. Just enter the wages tax withholdings and other information. If you make 55000 a year living in the region of New Hampshire USA you will be taxed 7717.

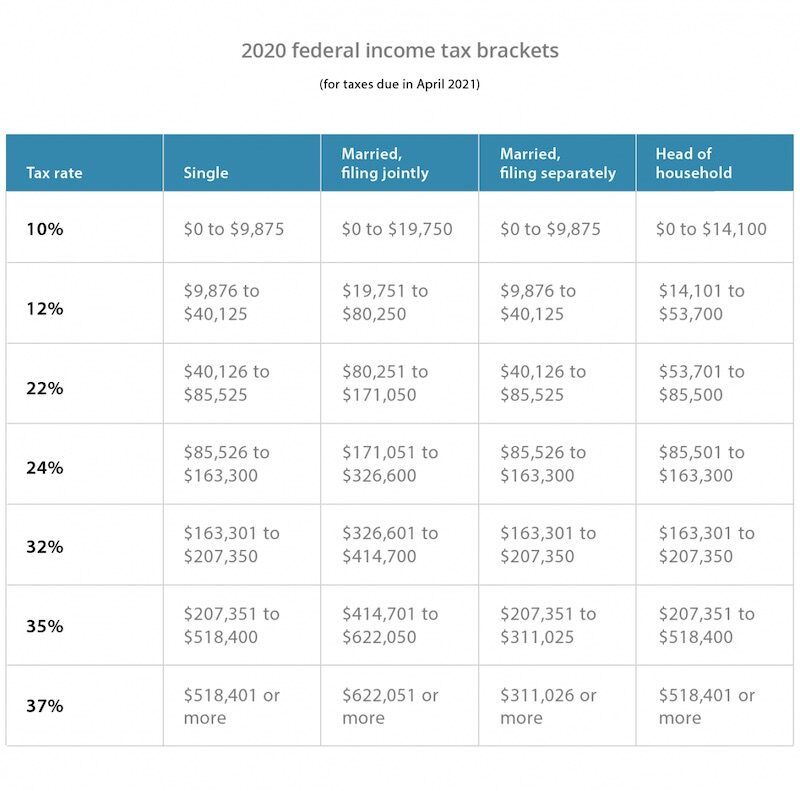

The Current tax rate. Highest income surcharge reduced from 37 to 25. A person with 15 lakh annual income will have to pay a tax of 15 lakh down from 187 lakh.

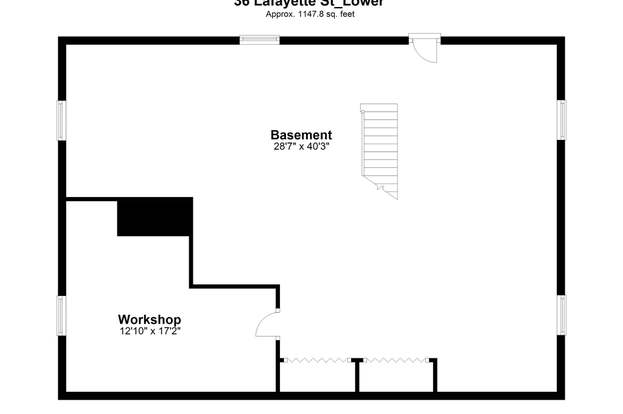

Weve teamed up with SimpleTax to bring you an online self-assessment tool. Assessing Tax Calculator The current 2022 real estate tax rate for the Town of Londonderry NH is 1848 per 1000 of your propertys assessed value. Your average tax rate is 1198 and your.

186 Average In this guide well deep dive into taxes in New Hampshire and what these taxes mean. That means that your net pay will be 43041 per year or 3587 per month. 5 Only on income from interest dividends Sales tax.

The annual amount is your gross pay for the whole year. There are no local income taxes in any. Use ADPs New Hampshire Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Safe and secure - protected by 256-bit encryption.

The state does tax income from interest and dividends at a flat rate of 5 though that rate is slowing being phase to 0 over the next few years. Tax Charts Tables. Value-Added Tax VAT VAT is the version of sales tax commonly used outside of.

The gross pay method refers to whether the gross pay is an annual amount or a per period amount.

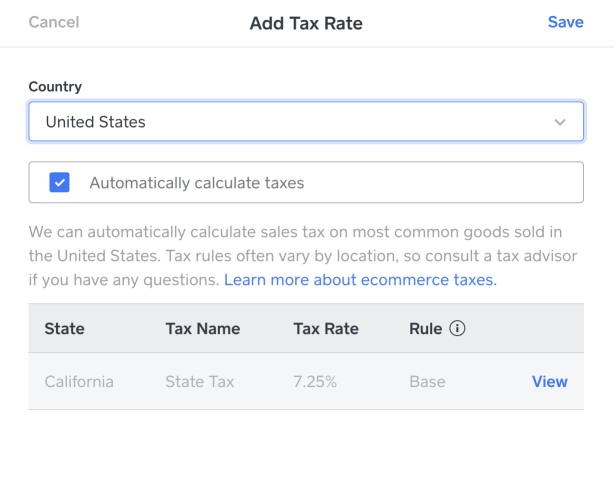

Create Tax Rates Weebly Support Us

36 Lafayette St Laconia Nh 03246 Redfin

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Growatt Solar Inverter 48v Spf 3000tl Lvm 48p Solar Off Grid Storage Solar Kit Depot

Va Funding Fee How Much You Ll Pay Quicken Loans

68 Thompson Mill Rd Lee Nh 03861 Mls 4919089 Redfin

68 Thompson Mill Road Lee Nh 03861 Compass

:max_bytes(150000):strip_icc()/Term-Definitions_Trailing-12-months-resized-54a44257bc8e4b43961562f43af4c1ee.jpg)

Hs10ofy Mf6udm

New Hampshire Hourly Paycheck Calculator Gusto

Tax Pros

New Hampshire Income Tax Calculator Smartasset

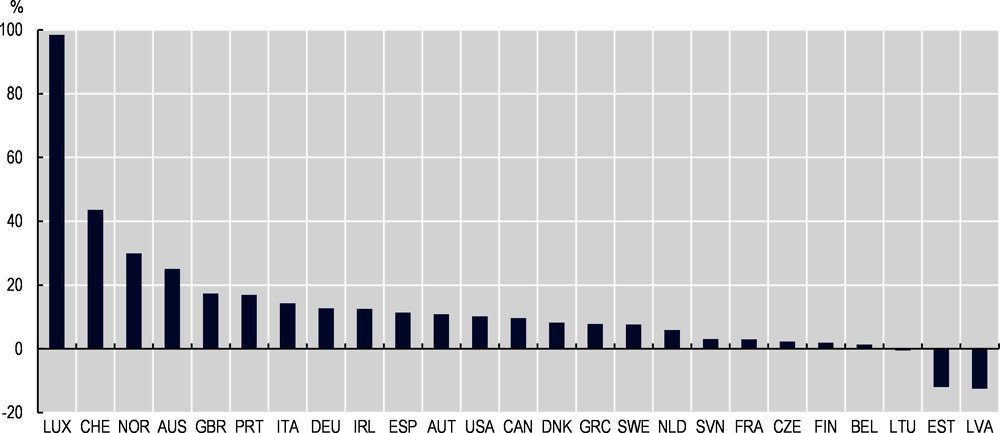

4 The Fiscal Impact Of Immigration In Oecd Countries Since The Mid 2000s International Migration Outlook 2021 Oecd Ilibrary

15 Minimum Wage Statistics Facts 2023

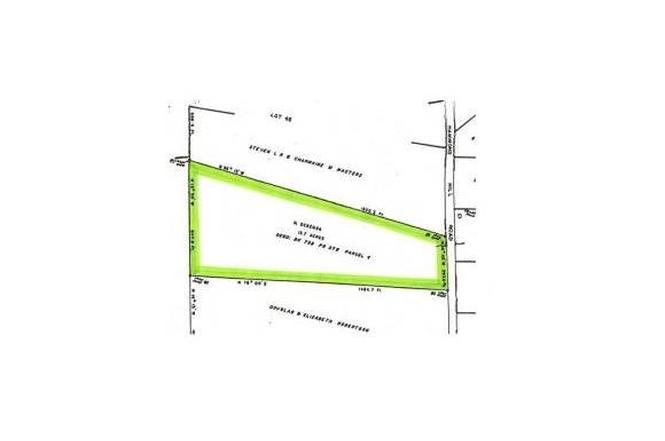

Hammond Hill Rd Bridgewater Nh 03222 Mls 4122899 Redfin

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax